Global markets are poised for more volatility next week with key economic data from China expected to show that the world's second-largest economy continues to grow at its slowest pace since the financial crisis, despite aggressive measures taken by the central bank to boost growth.

"There has been ongoing fear bubbling since August that the China slowdown is worse than expected. Investors are nervous that we'll see a massive downside correction in China's economy. That's why this data is so important to markets," said James Rossiter, senior global strategist at TD Securities.

China is expected to release fourth-quarter GDP, industrial production and retail sales data Tuesday morning.

Wasif Latif, who manages $1.6 billion at USAA Investments, agrees.

"These data reports next week could be very important in their power to either confirm or refute the current narrative that China is experiencing a very bad slowdown," said Latif.

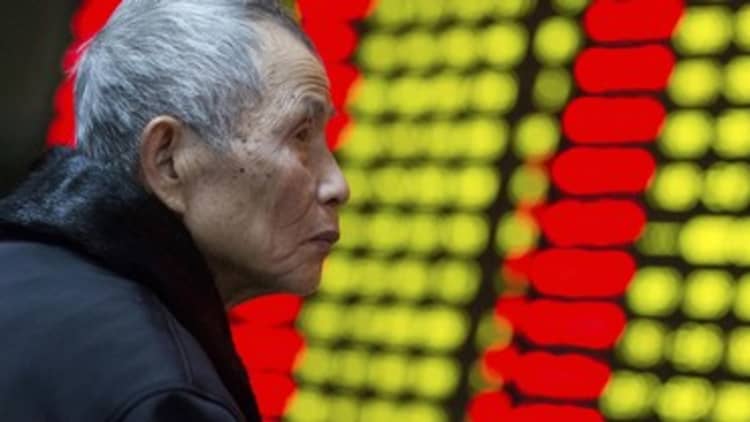

The kick-off to 2016 has been challenging to say the least for China which continues to show signs of weakness, particularly on the manufacturing and services front. This downbeat data has pushed investors to alter their global forecasts, readjust earnings expectations and talk about what life with a slowing China means for trading stocks bonds and commodities this year.

Markets around the world have been under pressure due in part to China worries. The Shanghai Composite is already down 18 percent this year and down over 40 percent from its June 2014 high.

Barclays strategists wrote that China remains a key source of turmoil as it affects currencies, commodities and financial volatility.

Analysts also point to Beijing's unpredictable nature in addressing the country's economic woes and market structure. For instance in the last week, China reversed a new rule on circuit breakers that had brought stocks to a complete halt after just minutes of trading.

Questions remain over whether the central bank of China will respond to weak data through its currency, or if the government will intervene in new ways if stocks continue to fall on the domestic markets.

It is also a lack of transparency in the country's management of its economy and financial system that concerns China watchers.

"(Peoples Bank of China's) policy intention and tool mix with respect to the exchange rate are hotly debated," wrote Tao Wang, UBS China economist in a note on Wednesday.

Wang went on to write that the CNY's relatively rapid depreciation last week surprised the market, against a back drop of volatility in its domestic stock markets. That has just added to confusion and concerns about China's economy, exchange rate policy and global markets.

Investors who spoke with CNBC say if the data disappoints, the central bank will be under more pressure to allow the onshore currency to weaken, which will most likely result in a widening spread between the onshore and offshore yuan.

That could spell trouble for stocks. Societe Generale team says widening spreads over the past nine months has been followed by a surge in U.S. equity market volatility.

"More important than how the Chinese stock market trades following the data releases is the level the yuan trades at — that is what global investors are paying attention to," said a portfolio manager who manages $4 billion in assets under management who preferred to be unnamed.

The first important economic release that could move markets will be China's fourth-quarter GDP number late Monday night New York time. Analysts are calling for 6.9 percent year over year for the fourth quarter. However, it is widely seen by China watchers as inaccurate and propped up by the government.

"Think there is downside risk, but then again, you never know how the numbers are going to be massaged," said Win Thin, global head of emerging markets at Brown Brothers Harriman & Co.

Ruchir Sharma, Morgan Stanley's head of emerging markets equity and global macro, said, "China's real GDP number is closer to 4 to 5 percent; 6.9 percent seems way too high."

Growth data from China is one of the last major economic releases before the Chinese New Year when analysts say there is a higher chance for seasonal distortions.

The other two data releases are industrial production and retail sales.

With China's slow transition from an export oriented to a consumption led economy — investors are likely to focus more on the retail sales number to get a gauge on consumer spending.

While fears around China have risen in the first two weeks of the year, market pros will likely look beyond economic data for clues as to how its economic slowdown is impacting global growth and companies that rely on sales in China.

"It may be more important to the market to get insight on what is happening inside China from upcoming earnings calls than from the economic releases. Last quarter, companies with manufacturing end-markets in China generally saw weakness while those with consumer end-markets generally saw resilient strength in demand. If earnings calls indicate the tone is changing on either side, the market could react sharply, no matter what the December economic data say," said Jeffrey Kleintop, chief global investment strategist at Charles Schwab & Co. to CNBC.

Lastly, keep an eye on how China intervenes in its financial markets. So far, large shareholders are still restricted from selling shares. The IPO system is not expected to start fully running till after March. Renewed signs of regulators beefing up their control of their financial system — delaying its move to market based system — may also dent investor sentiment.